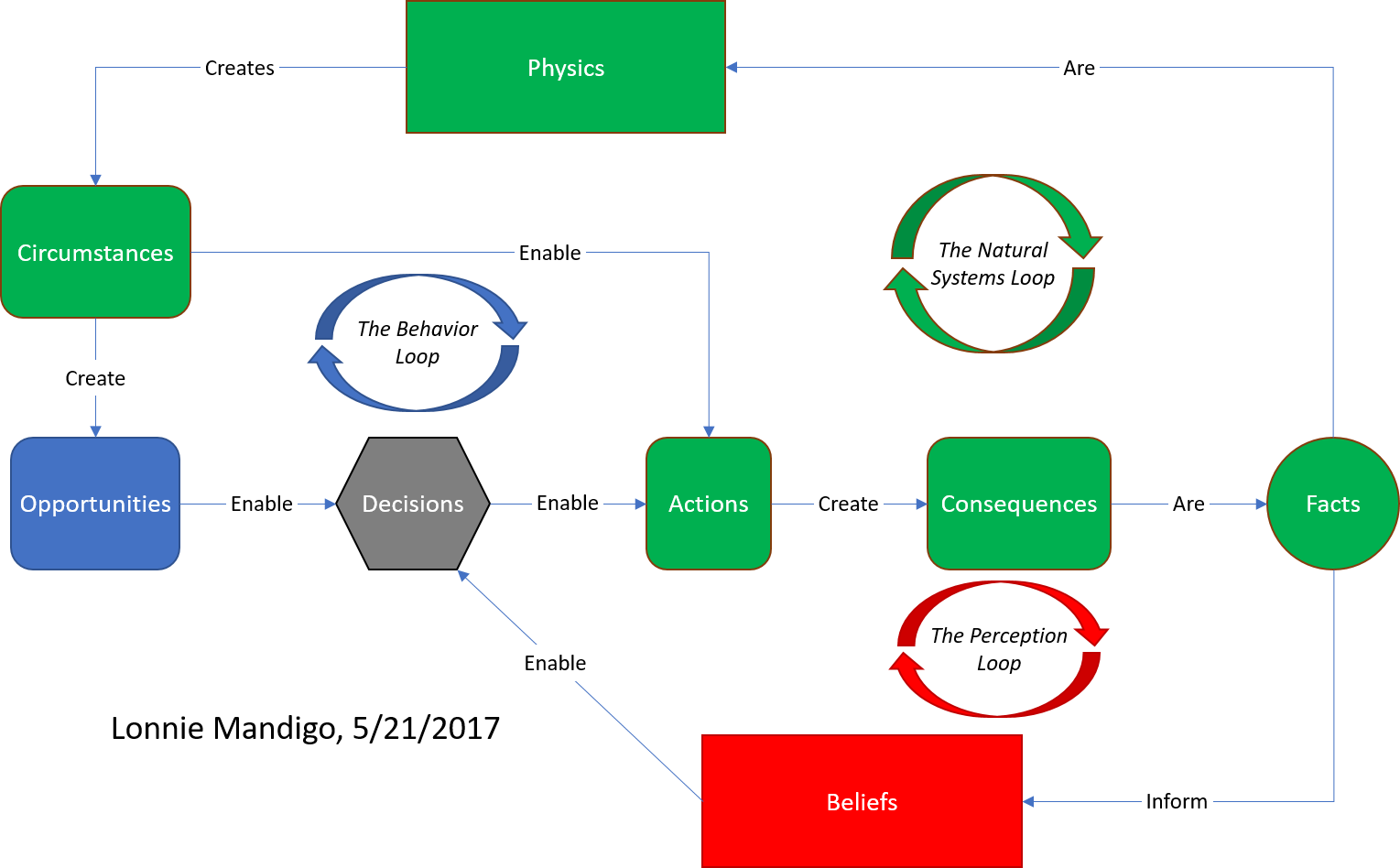

Some things just happen. They’re no one’s fault. There are no specific actions that could have been taken to avoid them. Sometimes life just sucks. When I see this I remind myself to not “argue with physics”. Physics isn’t good or bad, it just is. This reminder can help to bring my attention back to things I can influence.

Note that I’m not timid about what I believe I can influence. These things require the focused application of time, energy and insight. If you learn about what people have accomplished and are accomplishing then you know that we have an enormous amount of influence. We should not be timid, but we should insightfully and efficiently choose where we’re going to spend our time and energy. This is wisdom and it’s worth a lifetime of study and practice.