Human Evolution

Humans evolve in a way that transcends simple biological evolution. This view into evolution looks at how time and energy are utilized. Continue reading

Humans evolve in a way that transcends simple biological evolution. This view into evolution looks at how time and energy are utilized. Continue reading

Understanding the current political insanity is helped by understanding the broader forces in play. This post by Gail Tverberg is helpful. Continue reading

You may remember that about 6 months ago I mentioned asking Gail[1. Our Finite World – Gail Tverberg] about her alternative energy model. Her view is that energy that cannot be used and make a profit won’t be used – thus supply and demand mean that energy prices go down … Continue reading

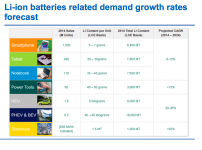

Some projections for the next 5 years during which the EV vs. petrol battle will be played out, as well as the grid storage transition. Continue reading

See Current and Future Cost of Photovoltaics Or Google “Fraunhofer solar future”. This is a hefty report by a very German organization i.e. they spent a year convening groups of experts in every aspect of solar and hammering all the aspects of death. Takeaways- though it’s pretty easy to read Solar power … Continue reading

[This is a note sent by my friend, Ian. It’s a pretty interesting and comprehensive look at battery technology and trends.] Continue reading

My friend Ian’s reflections on 2014. Continue reading

[My friend Ian Page, who researches and writes extensively about energy has graciously allowed me to repost some of his emails here.] by Ian Page, 2024.08.07 German Utilities Paid to Stabilize Grid Due to Increased Wind and Solar Its well understood that as the proportion of renewables increase, both stabilisation … Continue reading

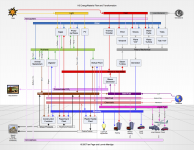

Here’s some work that Ian and I did in 2007 examining the various interconnected stocks and flows of energy and material that might exist at some point in the future. Continue reading